Every year, there are millions of taxpayers who find themselves unable to pay their taxes in full to the IRS. The IRS knows there will be some taxpayers coming up short. Good news! The IRS is happy to help with this. The bad news, however, is they are relentless in their collection of back taxes and if left unattended? Then they can levy your bank account, garnish your paycheck, or put a lien on your property to settle your tax bill.

The IRS’ cooperation comes at a price, though, called penalties and interest. Here are the steps you will need to take if you wish to pay your federal income tax with installment payments, below.

Before you proceed to navigating the complicated maze that is the IRS on your own, though, we strongly encourage all of our readers to speak with a qualified Tax Relief Expert at our office. You can schedule a confidential, no obligation consultation to explore your options for tax relief on our website.

www.LBSTAX.com

Here are some steps you can take to get on an IRS payment plan if you can’t pay your taxes in full.

File Correctly, and On Time

Trying shortcuts or using fake numbers on your tax return software to bring your tax bill down is not the answer. In fact, it will land you in deeper trouble. First, if you are going to owe tax and be unable to pay, your return will already face higher scrutiny as soon as you request a payment plan. So, making deliberate attempts to file a fraudulent return will only compound your problem, and will lead to more serious consequences.

Waiting until after April 15 to file a bad idea, too, because you will only get more penalties. Also, filing an extension does not mean you have more time to pay, but simply means you’ll end up paying more with penalties and interest, sinking you deeper into a hole you were already trying to get out of.

So make sure you file on time!

Attach Form 9465 Installment Agreement Request to your 1040 If You Need More Than 120 Days to Pay

WARNING: It’s best to hire a tax relief firm like ours to deal with the IRS directly. In most cases, our clients never speak to the IRS themselves as they have our firm speak on their behalf. One wrong move can put you further into tax trouble, so it’s best to have the right people representing you. Also, not everyone will qualify for an installment agreement. Contact us today to find out if you qualify, and what your steps should be.

www.LBSTAX.com

Ok, so, Form 9465.

This is the most important step. If you have a reasonable excuse for the delay in paying your taxes, the IRS can work out a 72 month payment arrangement. However, the late filing penalty can be as much as 5% per month of the outstanding tax debt, for each month or part thereof the tax is owed. The penalty is capped at a whopping 25% of the original tax owed. The failure to pay penalty is one-half of one percent (0.5%) each month up to a maximum of 25% as well. The interest is compounded daily; think of it like a credit card. The IRS charges interest on top of penalties and interest. There is also an administrative fee to set up the monthly payments, depending on how you intend to pay them. When you take into account the penalties and interest the IRS can assess, an IRS tax debt doubles every several years if you don’t address it head-on.

Applying for an Installment Agreement Online

Everyone has different situations in which different options are available to them. Payment options include full payment, a short-term payment plan (paying in 120 days or less) or a long-term payment plan (installment agreement) generally 72 months.

You may qualify to apply online if:

a. Long-term payment plan (installment agreement): You owe $50,000 or less in combined tax, penalties and interest, and filed all required returns.

b. If you are a sole proprietor or independent contractor, apply for a payment plan as an individual.

Wait 30 Days for a Reply (if by mail) and Make Sure the Installment Agreement Is Your Best Option

It takes the IRS at least 30 days to process an Installment Agreement Request form. Understandably, after March 31 of each year the processing time is a little longer due to the volume. During these 30 days, it would be a good idea to pursue other payment options as a back-up plan. Plan on paying the late fee penalty and interest when you are comparing the full cost of an IRS Installment Agreement or another loan, such as through a bank or other avenues of credit.

When bank loan interest rates are higher than 6%, the IRS Installment Agreement looks like a fairly good deal. However, tax payers in true financial dire straits due to job loss or other issues need to take a moment.

Defaulting on an IRS Installment Agreement is not the same as failing to pay your credit card bill for a month. The collections process by the IRS is backed by the federal government, and includes the ability to apply a tax lien against any property you own.

A delinquent taxpayer should also consider their ability to pay next year’s tax bill. If the initial cause of not being able to meet your tax obligation is recurring, for example related to a small business loss, certainly consider if the business is likely to weather a similar financial situation next year. You cannot secure another Installment Agreement if you are already paying one to the IRS. It may be prudent to pay this year’s tax with a loan at a higher interest rate if you have the credit available, and save the request for an Installment Agreement when you truly have no other option to meet your tax obligation.

Always Keep Careful Records of Forms Filed, and Any Correspondence with the IRS

During the entire process of requesting an installment agreement, it is very important that a taxpayer keep complete records. If there is communication by telephone, write down the time, date, and the person you spoke with in a log. It is also a good idea to briefly summarize the conversation, especially if there were any specific guarantees verbally given. Save all letters and notices from the IRS with your tax information.

There are a few reasons you’re going to want to keep these records. First, if something should happen to your paperwork, such as it becoming misplaced at the IRS office, you will have a back up to send and prove you complied with filing date requirements. Second, if the IRS fails to follow its own procedures and guidelines, you can contact the Taxpayer Advocate Service for help. Finally, just in case your failure to meet your tax obligation turns ugly and leads to litigation, your records are what your legal representation will need to show your effort in paying your tax bill.

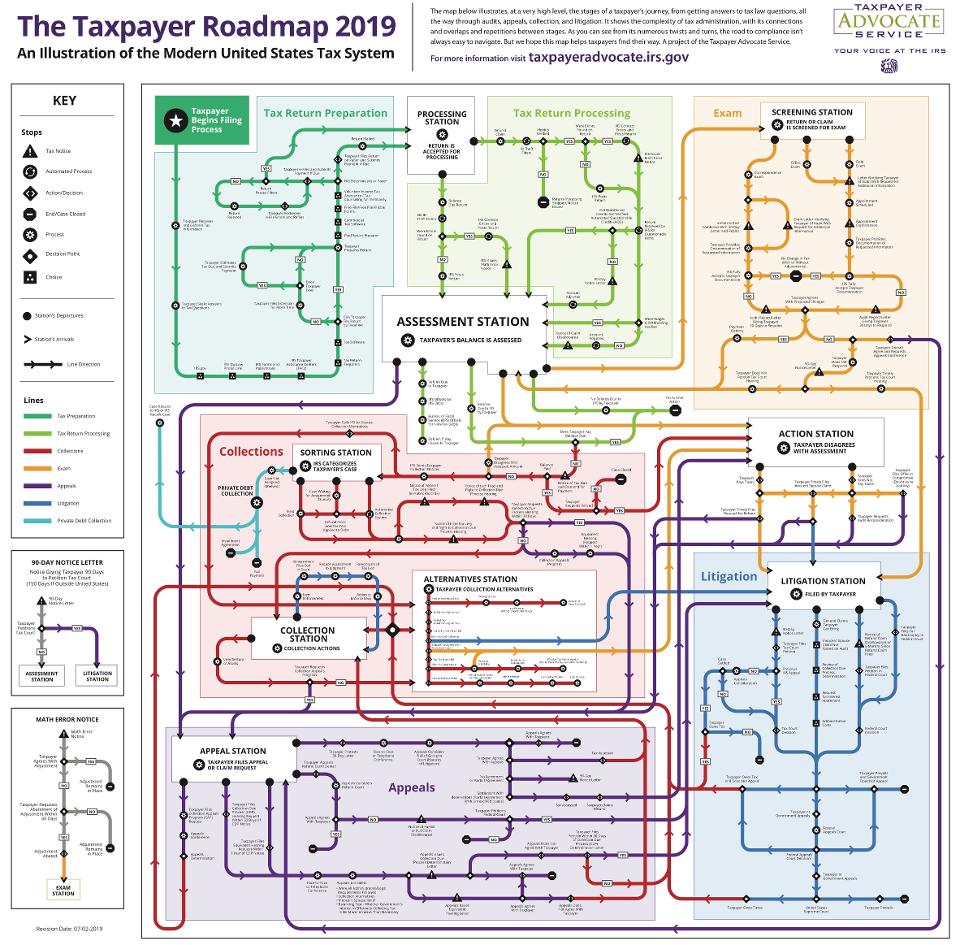

Our firm specializes in tax resolution, even if you have years of unfiled tax returns, we can help! You may qualify for the IRS’s debt settlement program called an Offer in Compromise, which can be more advantageous to you than a payment plan. We may be able to settle your entire debt with the IRS for up to 85% off the original amount owed, including penalties and interest, if you qualify. If you want an expert tax resolution specialist who knows how to navigate the IRS maze, reach out to our firm and we’ll schedule a no-obligation confidential consultation to explain your options in full to permanently resolve your tax problem.