Tax season is and unpleasant time of year for a lot of taxpayers, especially if you owe money to the IRS or State. The only thing you can really to make the most of it is prepare ahead of time, and pay the lowest amount allowed by law.

Whether you are getting a refund or writing a big fat check to the IRS, there are some steps that should be taken after your return has been filed. Here are three important steps to take once the tax filing deadline has ended.

Step #1: Print Hard Copies of All Your Forms and Receipts

Even if you save all of your documents on the computer the cloud, it is a good idea to print hard copies and store them in a safe place- in case something ever happens. From the 1099 forms detailing your interest and dividend payments, to the receipts of your charitable donations and business expenses, you never know when you will need this information again.

You will appreciate having those hard copies on hand if your computer crashes or your cloud storage service fails- it takes only a couple minutes of printing, and those couple minutes could save you weeks of hassle in the long run.

Step #2: Check Your ‘Refund Status’ or ‘Balance Due’ Online

Even if you file electronically, you cannot expect instant service on your tax refund- it is the IRS after all. Even with this, you should see quick action on your return and a notice that it has been accepted. Keeping an eye on your tax refund is one of the best ways to protect yourself and make sure the money you are owed does not end up in the hands of identity thieves.

This is also true if you owe money to the IRS. There have been tax identity theft cases where someone else files a tax return with your social security number, leaving you to deal with the liability or adding on to the amounts you owe.

If you use a tax filing software package, you should receive a notice by email when your return is submitted to the IRS, and then another when it has been accepted. Watch your email box carefully and follow up if you do not receive those notifications within a day or two.

Once a week has passed, be sure to check the “Where’s My Refund” page on the IRS.gov website to see where your refund stands. This tool is very handy and provides a real-time picture of your refund status, from the time it is received by the IRS to the moment the money is deposited to your bank account.

If you owe money, log in to your IRS account here https://www.irs.gov/payments/view-your-tax-account and check the balance to make sure it lines up with what you know you owe. If there are discrepancies, contact your tax resolution firm ASAP; of which we provide services to.

Step #3: Prepare for the Next Year

We know, we know. You just filed your taxes, and the last thing you want to do is think about filing for next year. Even though you feel this way, now is the perfect time to start getting your eggs in the basket for the filing season to come.

Start it off by looking at your current year’s return and think about ways you could have lowered your tax debt. Perhaps you could have given more to your favorite charity. Maybe you could have increased your retirement savings rate. Knowing what you did wrong this year will make it easy to adjust your strategy and save more money going forward for next year. If you’re not sure where to start make sure to ask your tax preparer for helpful tips!

Nothing can really make filing taxes a pleasant experience, but dealing with the IRS is something every American needs to do. Now that your tax return has been filed, and your 1040 form is on its way to the IRS, taking the right steps can save you money down the line, protect you from identity theft and make future tax dealings a little less stressful and more bountiful.

ABOUT OUR FIRM: LBS TAX &NEW FREEDOM TAX RELIEF, CHANDLER AZ

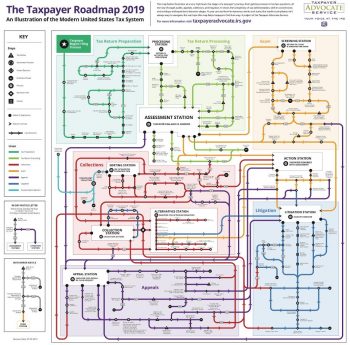

Our firm specializes in tax resolution, even if you have years of unfiled tax returns, or owe the IRS over $10,000, we can help! If you want an expert tax resolution specialist who knows how to navigate the IRS maze, reach out to our firm and we’ll schedule a no-obligation confidential consultation to explain your options to permanently resolve your tax problem.

Contact us here: https://www.lbstax.com/contact/