How a Small Business Tax Professional Can Help You Navigate the OB3 Act

Managing compliance, billing, and reporting has long been a significant challenge for businesses. Between juggling multiple agencies, tracking deadlines, and keeping financial systems aligned, business owners often find themselves buried in paperwork instead of focusing on growth.

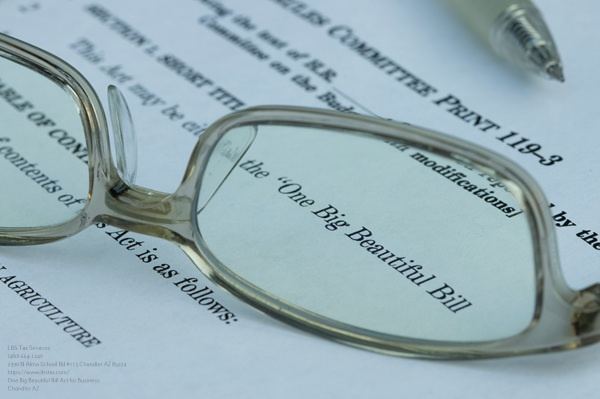

The One Big Beautiful Bill (OB3) Act for Business is designed to change that. This Act simplifies how businesses handle compliance by streamlining processes into a cohesive framework. Instead of navigating through layers of separate requirements, the OB3 Act creates clarity, efficiency, and transparency.

Partner with LBS Tax, your trusted small business tax professional in Chandler, AZ, and get expert support for your business taxes today.

Why the OB3 Act Matters?

1. Simplicity is Power

The OB3 Act enables businesses to consolidate multiple compliance tasks under a single umbrella. Think of it as a single roadmap — guiding billing, tax filings, and reporting obligations without the usual confusion.

2. Fewer Penalties, More Compliance

When deadlines are scattered across different platforms, it’s easy to miss something. By unifying reporting, the Act reduces the risk of errors and late filings, saving businesses money and avoiding unnecessary penalties.

3. Better Transparency for Owners

With a single streamlined process, business owners can gain a clearer picture of their obligations and cash flow. Instead of relying on fragmented systems, everything is connected in one place, making decision-making faster and more informed.

Which Sectors Benefit from the OB3 Act

The OB3 framework isn’t industry-specific — it’s designed to help businesses across multiple sectors where compliance and billing are especially complex.

1. Healthcare & Medical Practices

Hospitals, clinics, and private practices manage multiple billing systems, patient invoices, and insurance compliance requirements. OB3 brings it together under one bill.

2. Construction & Contracting

Contractors handle multiple permits, project-based billing, and payroll compliance. OB3 helps streamline reporting while keeping costs transparent.

3. Nonprofits & Charities

With strict reporting requirements and donor accountability, nonprofits benefit from clearer compliance structures under OB3.

4. Retail & Hospitality

Businesses with frequent transactions, sales tax obligations, and payroll needs can reduce administrative overhead and enhance cash flow visibility.

Do You Have Questions About Simplifying Your Taxes and Compliance?

Contact LBS Tax today for expert financial support tailored to your business needs.

Key Benefits for Businesses

- Unified Billing System: No more chasing down multiple invoices or platforms.

- Improved Compliance: Aligns with both state and federal requirements in a consistent way.

- Cost Savings: By reducing administrative work and penalties, businesses save time and money.

- Growth-Oriented: Frees up owners and managers to focus on strategy, clients, and opportunities.

Practical Tips to Prepare for the OB3 Act

1. Review Your Current Processes

Map out how your business currently handles billing, compliance, and reporting. Identifying overlaps will reveal where the Act can assist.

2. Invest in Integrated Software

Cloud-based accounting and compliance tools will facilitate a smoother transition when the Act takes full effect.

3. Consult with Experts

CPAs and compliance professionals can help tailor the Act’s framework to your business model, ensuring maximum benefit.

Why LBS Tax is the Right Choice for Small Business Owners

At LBS Tax, we understand the challenges small business owners face in managing business taxes, reducing tax liability, and staying up-to-date with complex tax returns and tax documents. Our dedicated team provides reliable small business services designed to solve tax problems while strengthening your business finances. From preparing accurate general ledgers, balance sheets, and income statements to reviewing every financial statement in detail, we deliver the comprehensive tax support you need. With expert guidance focused on your unique financial goals, we make sure your small business has the right strategy in place today and for the future. Choosing LBS Tax means choosing a partner who helps you simplify compliance, safeguard your finances, and achieve lasting growth.

Do You Have Questions About Simplifying Your Taxes and Compliance?

Contact LBS Tax today for expert financial support tailored to your business needs.